Direct Loan

Embarking on an adventure to uncharted terrain can be exhilarating. As you pack your bags and ready your spirit for the thrill of new travel destinations, there’s one vital aspect to consider – funding. As an adventure seeker, you would be familiar that traveling anywhere comes with costs. This is where a ‘Direct Loan’ steps in, a financial instrument designed specifically for individuals like you. This article will serve as your compass, guiding you through the often-confusing world of finance, pinpointing exactly how ‘Direct Loan’ can be your lifeline in this journey.

Understanding Direct Loans

Hey there! If you’re considering borrowing some funds, you’ve probably stumbled upon the term ‘Direct Loan.’ The word may trip you up at first, but don’t worry. You can understand this concept pretty easily.

Definition and explanation of direct loan

Let’s define our terms first — when we say “Direct Loan”, what are we talking about? In the simplest terms, a direct loan is money borrowed directly from a financial institution like a bank or a credit union. It’s usually a long-term loan that helps you cover various needs, such as tuition fees, home renovation or even when you need to shore up your small business. Borrowed funds must be repaid over time, along with interest.

Different types of direct loans

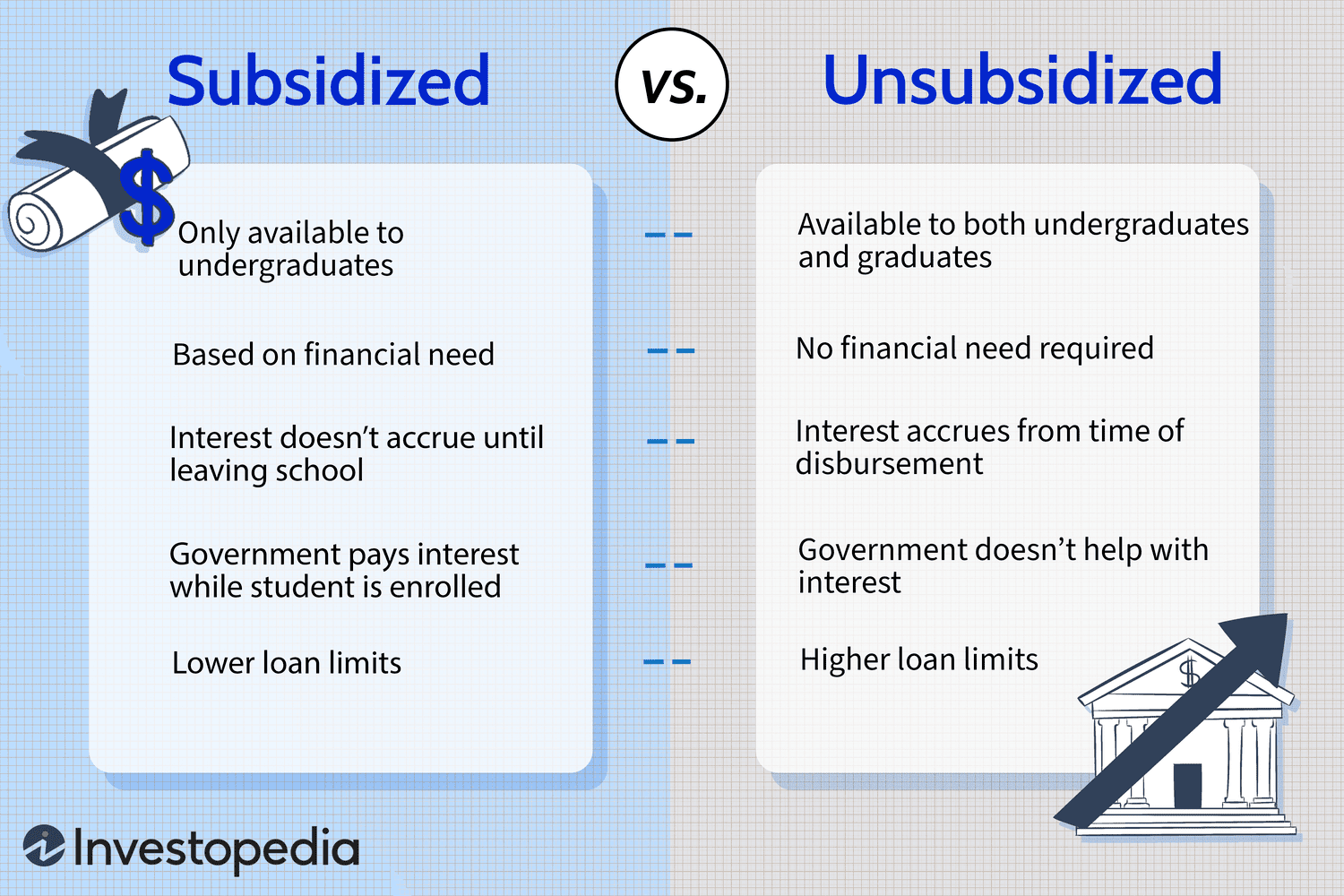

Just as there are many reasons to borrow, there are also different types of direct loans. You might look into a Direct Subsidized Loan or a Direct Unsubsidized Loan. Both are student loans from the U.S. Department of Education but the key difference is how interest accrues. There are also Direct PLUS Loans, perfect for graduate students or parents. For home buying and repairs, there are Direct Home Loans offered by the Department of Agriculture. Alternatively, folks looking to beef up their enterprise can try Direct Business Loans which come with specific terms for business owners.

How direct loans work

Direct loans work in specific steps: application, disbursement, repayment, and (if necessary) default. After applying and getting approved, loan funds will be directly disbursed to you. Repayment begins after an agreed period, and repayments involve both principal amounts and interest. Failure to repay results in loan default.

Advantages of Direct Loans

Direct loans, like every other financial instrument, come with their perks.

Low interest rates

A major advantage of direct loans is their typically lower interest rates compared to private loans. The interest rate on these loans is set by the government, meaning it is often more manageable than other kinds of loans.

Flexible repayment options

Repayment of direct loans is notable for flexibility. It range from standard plans (which ensure loans are paid within 10 years) to graduated plans (which involve lower repayments initially that gradually increase over time). If your income is a bit unpredictable, we also have income-driven repayment plans.

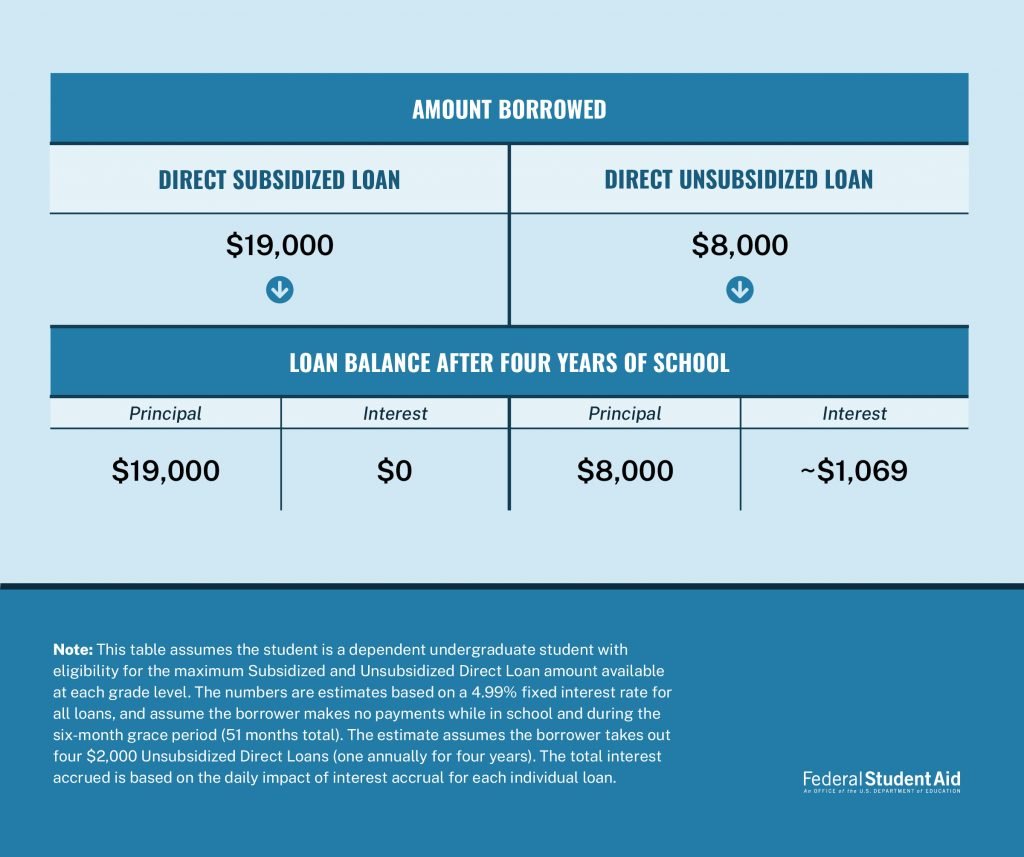

Subsidized interest costs

If you qualify for them, subsidized loans are a huge advantage. Why so? Because the government pays your interest while you’re in school at least half-time, during a deferment, and during the six-month grace period after you leave school. This can significantly reduce the cost of borrowing.

Disadvantages of Direct Loans

Before you jump headlong into it, you should know about some direct loan downfalls too.

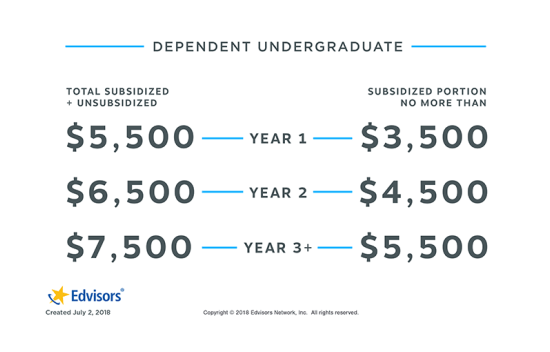

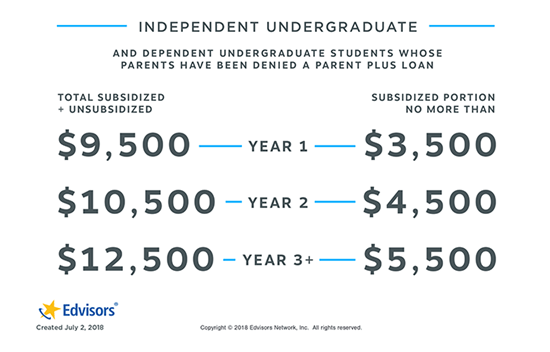

Limited loan amounts

With direct loans, how much you can borrow may not cover all your costs. There are limits set on how much undergraduate and graduate students can borrow. If you’re a parent borrowing on behalf of a dependent student, though, the maximum amount is usually the cost of attendance minus any other financial aid received.

Strict eligibility requirements

Direct loans come with a set of eligibility requirements. For student loans, students have to be enrolled at least half-time at an eligible school. For homeowners, you must live in an eligible rural area. For businesses, eligibility depends on the specific business loan type, but you generally have to meet certain size requirements and demonstrate that the loan will be used for a sound business purpose.

Impact on credit score

Borrowing a direct loan means debt which can impact your credit score. It’s not necessarily a negative impact, as making regular, on-time payments can actually boost your credit score. However, late payments or loan default can damage it severely.

Applying for a Direct Loan

So, you’ve considered the pros and cons, and you want to apply for a direct loan. Let’s show you how.

Understanding the application process

Applying for a direct loan does involve some paperwork. For student loans, the Free Application for Federal Student Aid (FAFSA) is your starting point. For home loans, you’ll apply through an approved lender and submit a variety of documents. Businesses have their own distinct processes too.

Required documents and credentials

In the application process, you will likely have to provide proof of identity, residency, income, and enrollment (for student loans). Business loans may require more complex documents such as business plans and financial statements.

Understanding your loan offer

Once application is approved, you get a loan offer. But don’t jump just yet! Ensure to understand loan amount, interest rate, repayment terms among other things. Have this information at your fingertips before accepting any loan offer.

Repaying your Direct Loan

Once you’ve got the loan, the next important step is paying it back.

Different payment plans

You can choose from several repayment plans like the Standard Repayment Plan, Graduated Repayment Plan and the Income-Driven Repayment Plans among others–this flexibility allows you to choose what’s best for you.

How to handle late or missed payments

Late or missed payments happen, but there are steps to handling them. Usually, you’ll have a 15-day grace period after your due date to make a payment without penalty. If problems persist, reach out to your loan provider for assistance. They can provide options for payment assistance or loan modification.

Deferment and forbearance options

If you’re facing economic hardship, you can request a deferment or forbearance, which temporarily reduce or halt your loan payments. Such options, though helpful, might extend the repayment period and accrue more interest.

Direct Loans for Students

If you’re a student, getting a Direct Loan can help bridge a gap in your educational costs. Let’s drill down a bit.

Understanding student direct loans

Student direct loans are provided by the U.S. Department of Education to help students cover educational costs. They range from Direct Subsidized Loans (for eligible undergraduate students), Direct Unsubsidized Loans (for eligible undergraduate, graduate, and professional students), to Direct PLUS Loans for graduate/professional students or parents of dependent undergraduates.

Application process for students

To apply, you have to fill the FAFSA, prove your enrollment in an eligible school at least half-time, and meet other general eligibility criteria (like citizenship and academic performance).

Repayment options for student loans

Repayment usually starts six months after you graduate, leave school, or drop to less than half-time enrollment. Different repayment options are available, based on your income, family size and total loan amount.

Direct Loans for Home Mortgages

If homeownership is your goal, you might consider a direct home loan.

Using direct loans for home purchase

Direct loans can be used to purchase, build, improve, or repair a home. They primarily serve low- and very low-income individuals and families in eligible rural areas.

Different direct home loans available

The USDA provides several types of home loans, including direct home loans (for low- and very low-income applicants), single family housing guaranteed loans (for higher income borrowers), and single family housing repair loans and grants.

Repayment strategies for mortgage direct loans

For mortgage repayments, bi-weekly payments could be a smart tactic. By doing this, you end up making an extra month’s payment each year — chopping down your mortgage faster. Always ensure to fully understand the repayment terms before taking up the loan.

Direct Loans for Small Businesses

Are you running a business? There are direct loans for that.

Advantages for businesses

Direct Business Loans can provide a much-needed capital boost to help buy equipment, increase inventory, or even expand your business. They typically have fixed interest rates and a variety of repayment terms, so you can tailor the loan to your business’s needs.

Application process for businesses

Businesses in need of funds should check the Small Business Administration. After determining eligibility, the SBA will guide you through the loan application process which often requires much paperwork including business plans and financial statements.

Repayment strategies for business direct loans

Smart tactics include making extra payments when financially feasible and consistently making payments on time. It’s a fundamental way to chip away at your balance and show potential lenders that you’re creditworthy.

Direct Loan Consolidation

Borrowers with multiple federal student loans might consider a Direct Consolidation Loan.

Benefits of loan consolidation

Loan consolidation can streamline your loan repayment by combining all your federal student loans into a single loan with one loan servicer and one monthly payment. A Direct Consolidation Loan could also lower your monthly payment amount and give you access to additional loan repayment plans or forgiveness programs.

Application process for consolidation

The consolidation process starts at the Federal Student Aid’s consolidation page, where you can apply for free. Once applying, you get to choose the loans you want to consolidate and your repayment plan.

Repayment under consolidation

As with any federal student loan, you’ll have several repayment options available, ranging from a standard repayment with fixed monthly payments to various income-based repayments.

FAQs on Direct Loans

With all said, you might have a few more questions up your sleeve.

Common questions on direct loans

Common questions handle application process, eligibility requirements, and repayment terms. It’s a whole lot of jargon we know, but who said it can’t be demystified?

Troubleshooting common issues

Some might encounter issues such as difficulty repaying, or confusion on loan terms. No worries — plenty of help is available. Reach out to your loan servicer to discuss any challenges you’re experiencing.

Resources for further assistance

For more information, you can consult the Department of Education’s Federal Student Aid Office, the Department of Agriculture, or the Small Business Administration. They provide comprehensive resources to help guide you through direct loan processes.

Now that you have a better understanding of direct loans, weigh your options critically and make the choice that’s best for you. Remember, borrowing responsibly is key to a healthy financial future.